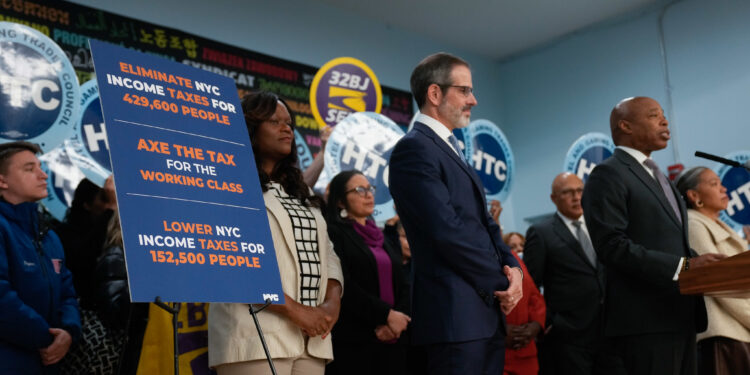

On Wednesday, December 4th, New York City Mayor Eric Adams unveiled a new initiative, the “Axe the Tax for the Working Class” proposal, to provide much-needed tax relief to working-class families. The plan would eliminate New York City Personal Income Taxes for filers with dependents who live at or below 150% of the federal poverty level, benefiting more than 582,000 New Yorkers.

This proposal directly responds to the rising cost of living in New York City, which has made it increasingly difficult for working-class families to make ends meet. The plan would return over $63 million to residents if enacted, offering a financial lifeline to struggling families.

“Extreme costs are driving many working-class families out of cities like New York, and while, for too many decades, across too many administrations, we let these problems languish, our administration said enough is enough,” said Mayor Adams. “This ambitious plan will put more than $63 million back into the pockets of over 582,000 New Yorkers.”

The proposal significantly expands the Adams administration’s efforts to provide financial relief. Last year, Mayor Adams successfully pushed for an increase in the New York City Earned Income Tax Credit (NYC EITC), which delivered over $345 million in relief to New Yorkers. The new “Axe the Tax” plan and the enhanced NYC EITC will provide $408 million in tax relief to 2 million residents across the five boroughs.

The plan will primarily target working-class families with children. For example, a family of four earning less than $46,350 annually would see their income taxes eliminated. Families just above the threshold would also receive significant reductions in their tax burdens. The total relief could be as much as $822 for specific households, combining both the “Axe the Tax” proposal and the enhanced NYC EITC.

Assemblymember Rodneyse Bichotte Hermelyn, who has been a strong advocate for the proposal, added, “Despite the extraordinary progress we have made in creating a safer, more affordable city for New Yorkers, we know that there is even more we can do to support our working-class families.”

New York State Senator Leroy Comrie, a supporter of the proposal, said, “At a time when families need extra help with rent, child care, groceries, and more, this bold proposal will give tens of millions of dollars back to New Yorkers and help make our city more affordable for families.”

Assemblymember Bichotte Hermelyn and Senator Comrie will introduce the proposal to the state legislature in the upcoming legislative session, with the goal of passing it as part of the Fiscal Year 2026 state budget.

The plan builds on other successes of the Adams administration, such as the “NYC Free Tax Prep” program, which has already helped New Yorkers save nearly $57 million in tax preparation fees.

As the proposal moves through Albany, the mayor’s office hopes it will provide direct financial relief to New York City families and serve as a model for other cities facing similar affordability challenges.